What is a P11D?

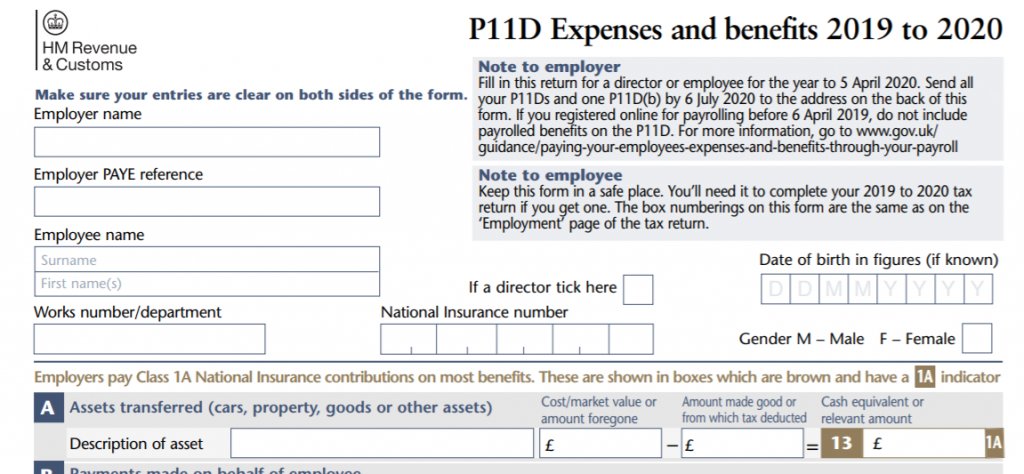

The P11D form is a statutory form required to be filed with HMRC by those businesses that provide benefits to their employees that do not go through the PAYE system. You will also need to file a P11D(b) alongside it.

Who needs to complete a P11D?

Employers who have paid benefits to employees during a tax year need to complete them, unless those benefits have already been subject to income tax and national insurance through the PAYE scheme – known as “payrolling”.

Who receives a P11D?

Employees who have been paid benefits during a tax year and earnt more than £8,500 should receive a P11D, unless the benefits have already been processed through PAYE or are considered ‘trivial benefits‘.

What kind of things will be included as expenses and benefits?

Any benefits you have received from your employment should be included that aren’t considered ‘trivial’. These may include, but are not restricted to, things like private health care, company cars, childcare and private fuel paid. Read here for the full HMRC list.

What is the purpose of the forms?

The P11D is used to calculate whether any additional Class 1A national insurance is due to be paid to HMRC by the employer, as they treat these benefits as additional salary. The employee will also be subject to additional income tax on the cash equivalents of these benefits as though they had been paid them as salary.

The employee’s tax code will be adjusted in the following tax year to take account of the income tax due on the benefits received, so if you disagree with HMRC’s adjustment you may need to refer back to it.

If you have to complete a self-assessment personal tax return, the benefits you received detailed on the P11D also need to be included within the employment income section and will be taxed as such.

Exemptions and dispensations

You can no longer apply for dispensations, but Exemptions cover some routine business expenses and these do not need to be reported on a P11D.

You don’t have to report certain business expenses and benefits like:

- business travel

- phone bills

- business entertainment expenses

- uniform and tools for work

In order to qualify for an exemption, you must be either be:

- paying a flat rate to your employee as part of their earnings – this must be either a benchmark rate or a special (‘bespoke’) rate approved by HMRC, for example paying 45p per mile for mileage, or

- paying back the employee’s actual costs so that the employee receives no benefit

What are the deadlines for filing a P11D?

The deadline for filing is 6th July after the end of the tax year, and the payment of any NIC resulting from them is due by 22nd July. Employees must also be provided with a copy of their P11D by 6th July at the latest. For the 2021/22 tax year the deadline for filing is 6th July 2022 and any payment is due by 22nd July 2022.

What if I don’t file or pay on time?

You’ll get a penalty of £100 per 50 employees for each month or part month your P11D(b) is late. You’ll also be charged penalties and interest if you’re late paying HMRC.

If you are unsure if you need to complete and file P11Ds, ask your accountant for advice.